Analysis of Impact of Owner Departure

By Scott Gabehart, Chief Valuation Officer for Bizequity, LLC

Introduction

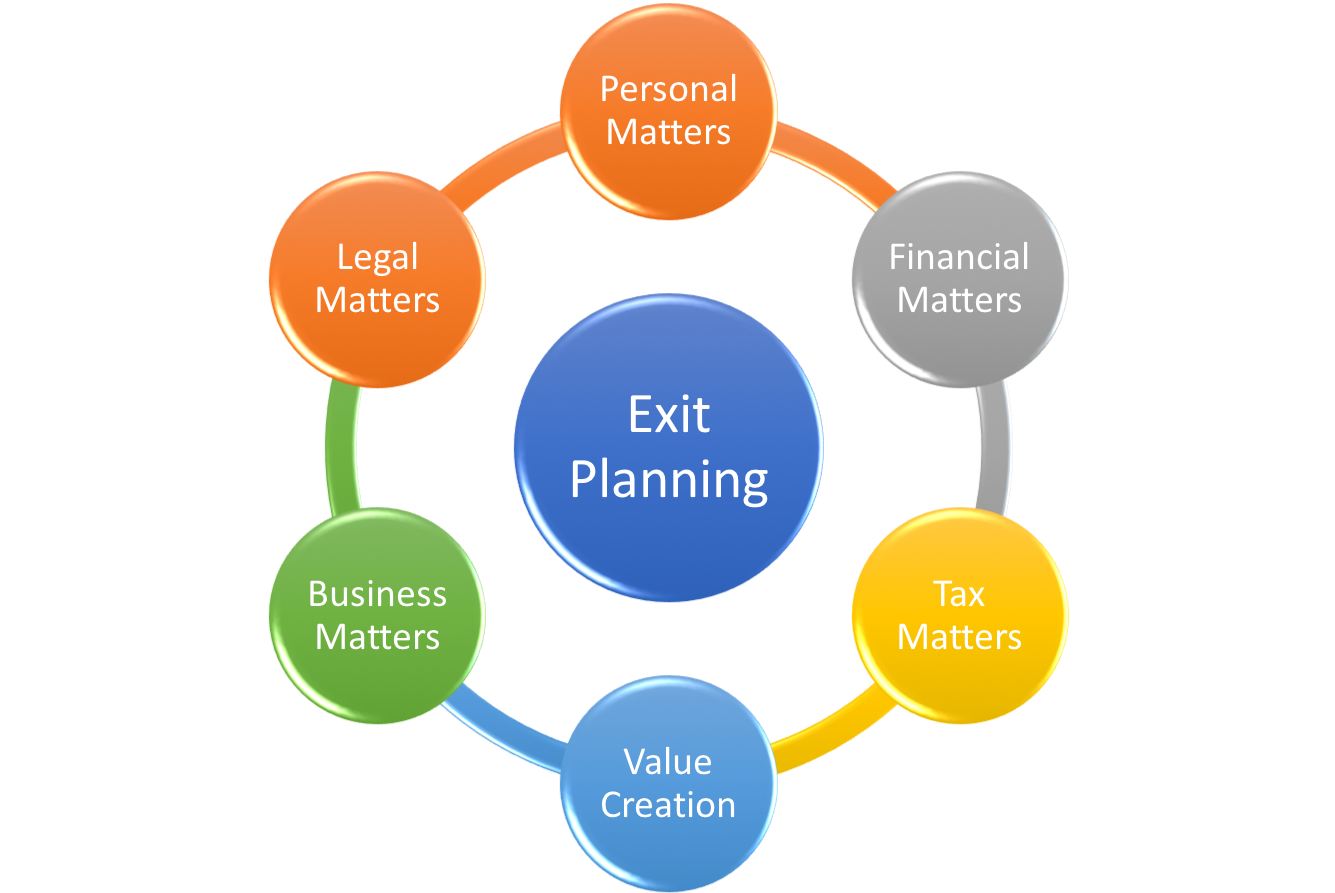

The sad truth is that many entrepreneurs devote most of their effort towards building their business without realizing that much of the “value” can be lost at the time of sale if the

proper planning steps have not been implemented years in advance. Most advisors agree that it is never too soon to begin planning for an exit, but many helpful changes can be implemented over a three-year period once an exit is being planned. Experienced wealth advisors and insurance agents can educate the business owner about these tactics designed to avoid unpleasant choices, avoidable tax liabilities – and loss in business value.

The majority of private firms are started, owned and led by a single owner working at the business on a full-time basis. It is only natural that this individual play the pivotal role in building the company over time by making key decisions, working the most hours and developing the most important relationships with employees, suppliers, customers and

consultants. The more dependent the business is on the owner, the sooner any type of exit planning or estate planning should take place.

Business Valuation Perspective and the BizEquity System

From the perspective of business valuation, it is widely recognized that significant value is associated with key employees and active owners (who are in fact key employees). The loss

of a key employee can harm both the top line (loss of customers and sales) and the bottom line (less productive replacements and loss of historical business-specific knowledge) with a

corresponding impact on business value. The more direct the relationship between the primary owner and the customer base, suppliers and employees, the greater the potential loss of value at the time of departure.

Market evidence of the value associated with the owner can be found in the common purchase of “keyman insurance”. In the event of death or disability, the business (or its other shareholders) will be compensated for the loss in value attributed to this key person’s contribution to the business. Quantifying the specific valuation impact of the departure of the primary owner-operator is easier said than done. Like many other aspects of business valuation (or economics), answers come in shades of grey rather than black and white. One of the more difficult risks to evaluate when determining a business’s value is the effect of losing a key person.

The answer boils down to a fair assessment of the question: “What will happen to the future revenues and profits of the business if the owner departed today and was replaced by a new owner-operator”

The BizEquity System

The BizEquity system includes a “slider” on Step 7 which specifically addresses this question. There are four possible selections:

Owner Leaving Impact

- Remain the Same

- Decline Minimally

- Decline Moderately

- Fall Substantially

- Plummet

The impact on the firm’s asset sale value (the base value of a typical transaction – inclusive of inventory, FF&E plus intangible assets like goodwill, covenant not to compete, etc.) will range between roughly 0% and 25% depending on the selection above and the specific industry (type of business). The impact of an owner departure is likely to be greater for a professional practice than a manufacturing company with a management team, but remember that the typical or average valuation multiples utilized for any given type of business ALREADY account for the general impact of the typical owner-operator departing at the time of sale.

Note that the impact on the firm’s “equity value” will be quite different due to the inclusion of the full balance sheet in the valuation estimate. In order to impute the impact of the owner departure on an “apples to apples” basis, the adjustment is made via the asset sale value which in turn is reflective of the typical or average multiples paid for any particular type of company (all other things equal).

Discussions With Owners

Any conversation with a business owner about this topic can focus on the major issues of exit planning, e.g. the purchase of keyman insurance and tactics which reduce the impact of an expected future owner departure. In short, the less dependent the day to day operations are upon the presence of the owner, the greater the business value. Having a protégé in training or reducing the areas of responsibility for the primary owner are both helpful maneuvers.

Building a succession team or selling to an ESOP (employees) should be considered. In practice, I have seen potential buyers swayed by the fact that the owner has been able to take numerous 2 to 4 week vacations without harming the business or its financial results. Another tactic for optimizing value at the time of sale is to provide a prolonged transition or training period (depending on the needs and preferences of the buyer and seller). Due to the nature of small, closely-held businesses, key person risks are often unavoidable.

They can, however, be managed.

Some ways to mitigate the impact of key person risk on the value of your business according to the Olsen Thielen Adviser include:

Transition Customer Relationships – Strong customer relationships are a significant part of any successful business. However, the business becomes vulnerable when the

relationships are cultivated and managed by one individual. When possible, other members of the team should be brought in to important meetings and decisions or to

relational events like dinners or sporting events.

Shift Focus to Company Brand – It can be difficult to separate the company brand from the skill, experience, and reputation of the company’s founder. Business owners are often the face or voice on television or radio commercials, and perhaps their name is even part of the company name. While these are often successful strategies, the result can be the company taking a backseat to the owner. Shifting brand focus to reflect the fact that the company is bigger than any one individual can mitigate key person risk.

Share Technical Knowledge or Skills – Small businesses are often built upon the knowledge and skill of their founders. Every effort should be made to make sure that these are passed to others within the organization so service issues are mitigated upon your departure. In highly technical fields, this can be a significant challenge. However, to the extent that it is possible, it can have a positive impact on key person risk.

Institutionalize Company Culture – Small businesses also often take on the personality of their founders. Employees take cues from you as it relates to making decisions, dealing with customers and coworkers, and handling issues and problems. By clearly documenting, communicating, and implementing processes and procedures at every level of the business, you can help ensure that the culture you’ve worked hard to build survives your departure.

Employment or Non-Compete Agreements – If selling, you can get more potential value at the sale if you agree to either work for or not compete with the buyer for a certain period of time. The specifics of these agreements are part of the negotiation process and should be based on your needs and desires after the sale.

Conclusion

Business valuation boils down to the amount of cash flows that are available to a prospective owner-operator and the riskiness of those cash flows. The presence of owner dependence affects he risk profile of future cash flows and will therefore impact the price and marketability of the business and influence the structure of the planned transaction. Fortress Business advisors can help to educate a business owner about the presence of key person risk and how to minimize it at the time of sale

ready to reach new heights? Let's get there, together.

Call us today for a complimentary review!